Uninsured/Underinsured Motorist Coverage

Buy Your Own Coverage!

No one wants to get into an auto accident, but you should be protected if one does happen. First, your insurance has to be current. Second, you need uninsured motorist/underinsured motorist coverage, commonly called UIM coverage. This is money to pay you if the other driver doesn’t have any insurance or not enough to cover your damages.

Your insurance company is required to offer you UIM coverage. The basic auto insurance is liability coverage. Liability coverage pays when a driver hits you and is at fault. The minimum limit for liability insurance in California, unfortunately, is $15,000.00. That means if someone with a minimum policy hits you, that’s the most insurance money you can recover.

In steps UIM coverage. You can buy coverage from your own insurance company above this minimum limit to protect yourself. This is an investment in yourself and your family by adding coverage to protect against bad luck.

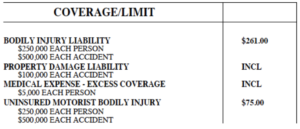

This is what the line item looks like on your declaration page from my own policy:

Liability coverage matches UIM coverage. So if you want to get $250k in UIM coverage, you need to purchase $250k of liability coverage. Here, you can see that I paid $261.00 for six months of the liability coverage, and $75.00 for six months of $250k/$500k UIM coverage. That’s only $150.00 a year. The $250k, by the way, is for one person. The $500k (an additional $250k) is for when there is more than one person in the car, so that’s for passengers.

The only thing you need to do is call your insurance company and ask for a UIM quote. There are varying levels, but as you can see the cost is low to the amount of coverage you can get. The coverage can range from $30k up to $1 million.

If you are in an accident and you need to use your UIM coverage, then I will help you. They are still insurance companies, right? They still try to pay a lower amount for claims. I have experience fighting insurance companies to pay claims fairly to compensate you for your injuries.